Investing can feel overwhelming. Especially for beginners.

But it doesn’t have to be. Low-risk investments offer a safe path to grow your money. They are a great starting point. This blog will explore 48 low-risk investment options. It’s perfect for those new to investing. Starting with low-risk investments can boost your confidence.

These options help you understand the market without fear of losing money. They provide stability and a chance to see your savings grow steadily. You won’t get rich overnight, but you’ll gain valuable experience. This experience is crucial for making informed choices later. As you read on, you’ll discover options like savings accounts, bonds, and more. They are simple and accessible. Dive in to learn about these investment choices, and find what suits your needs best.

Credit: www.siegelgale.com

Introduction To Low-risk Investments

Investing can feel daunting for beginners. Many fear losing their money. Low-risk investments offer a solution. They provide a safe way to start investing. These options help preserve your capital. They also offer steady returns over time. Low-risk investments are ideal for building confidence. They are great for those new to the world of investing.

Why Low-risk Is Ideal For Beginners

Beginners often lack experience. They might not understand market trends. Low-risk investments are forgiving. They help avoid major losses. This makes them perfect for learning. Beginners can test the waters safely. They also allow time to learn investment basics. This creates a strong foundation for future ventures.

Benefits Of Secure Investment Choices

Secure investments offer peace of mind. They protect your initial capital. This is crucial for new investors. You can watch your money grow slowly. There’s less stress about sudden losses. These investments often provide consistent returns. This reliability can be reassuring. It also helps build trust in the investment process.

Savings Accounts

Savings accounts offer a secure way to start investing with minimal risk. Ideal for beginners, they provide stability and easy access to funds while earning interest. Perfect for those seeking low-risk options, they help build a strong financial foundation.

Savings accounts offer a safe place for your money. They are perfect for beginners. You deposit money and earn interest. This makes them a low-risk option. They are easy to access and manage. They help you save for future goals. They provide a secure way to grow your savings. Let’s explore their features and benefits.Features Of Savings Accounts

Savings accounts are simple and straightforward. You can open them at any bank. They require a small initial deposit. You can deposit and withdraw money easily. They come with no risk to your principal amount. Banks usually offer online access. This allows you to track your balance anytime. They are insured by government agencies. This makes them a safe choice for keeping money.Interest Rates And Returns

Interest rates vary among banks. They are usually low but stable. You earn returns on your deposited money. Interest is often compounded monthly. This means your money grows over time. Though rates are low, they are reliable. This makes savings accounts a safe investment. They suit those who prefer security over high returns.Certificates Of Deposit (cds)

When you’re new to investing, finding a safe place to grow your money can be a daunting task. Certificates of Deposit (CDs) offer a straightforward solution, combining safety with a predictable return. They are a popular choice for beginners because of their low-risk nature and simplicity. Let’s dive into how CDs work and how you can choose the right CD term for your financial goals.

How Cds Work

Think of a CD as a special savings account where you agree to lock away your money for a set period. During this time, your bank or credit union pays you interest, which is typically higher than a regular savings account.

The catch? You can’t access your funds until the CD matures, which can range from a few months to several years. If you need to withdraw early, you might face penalties that reduce your earnings.

Picture this: My first CD was a 12-month term that earned more interest than my usual savings. It felt reassuring watching my money grow without worrying about market swings. What about you? Would a CD fit into your financial plan?

Choosing The Right Cd Term

Choosing a CD term is like picking the right-sized container for your money. The term length affects the interest rate and your access to funds. Shorter terms offer more flexibility, but longer terms often come with higher rates.

Consider your financial goals. If you’re saving for a vacation next year, a 12-month CD might be ideal. But if you’re planning for a future event like buying a house, a 5-year CD could earn you more interest over time.

It’s also crucial to compare rates from different banks. Some might offer special promotions with better returns. Have you compared CD rates recently? You might find an opportunity to maximize your savings.

CDs are a great option for those who value stability and predictability. As you explore your investment options, think about how a CD could fit into your strategy. What would you do with the extra interest earned?

Credit: reelex.com

Treasury Securities

Treasury securities are safe investment options backed by the U.S. government. They offer low-risk opportunities for beginners looking to invest. These securities are popular due to their stability and reliability. Investors often choose them for their predictable returns and security.

Types Of Treasury Securities

The U.S. Treasury offers different types of securities. Treasury bills are short-term investments with maturities of one year or less. Treasury notes have maturities ranging from two to ten years. Treasury bonds are long-term investments, with maturities of more than ten years. Each type has its own benefits and can suit different investment needs.

Advantages Of Government Bonds

Government bonds provide several advantages for investors. They are considered very safe because they are backed by the government. The interest earned is exempt from state and local taxes. This feature can increase the overall return for investors. Government bonds are easy to buy and sell on the secondary market. Their liquidity is attractive for investors seeking flexibility.

Money Market Accounts

Money market accounts can be a smart choice for beginner investors. They offer a unique blend of benefits. These accounts combine features of savings and checking accounts. Providing better interest rates than regular savings accounts. They also offer easy access to funds. Perfect for those seeking low-risk investment options.

Differences From Savings Accounts

Money market accounts differ from savings accounts in several ways. The interest rates are usually higher. This means you earn more on your deposits. They often require a higher minimum balance. Savings accounts typically have lower minimum balance requirements. Money market accounts may allow check-writing privileges. Savings accounts do not usually offer this feature. This makes accessing funds simpler.

Evaluating Interest Rates

Interest rates in money market accounts vary among institutions. Compare rates before opening an account. Higher interest rates mean better returns on your money. Check how often interest is compounded. Daily or monthly compounding affects overall earnings. Review fees associated with money market accounts. Fees can reduce your returns. Always read the terms carefully.

Corporate Bonds

Corporate bonds offer a stable way for beginners to invest. These bonds are considered low-risk and provide steady returns. Ideal for those new to investing, they help diversify portfolios without high risk.

Investing in corporate bonds can be an excellent choice for beginners seeking low-risk options. Corporate bonds are essentially loans you give to a company. In return, the company pays you interest over a fixed period. They offer a relatively stable income stream, making them attractive for those new to investing. But like any investment, understanding the risks and rewards is crucial.Assessing Bond Ratings

Before investing in corporate bonds, take a close look at bond ratings. These ratings are assessments of a company’s creditworthiness. Agencies like Moody’s and Standard & Poor’s provide ratings that indicate how likely a company is to pay back its debt. A higher rating, such as AAA, suggests a safer investment. However, lower-rated bonds might offer higher returns to compensate for increased risk. Think about what level of risk you’re comfortable with before making a choice.Balancing Risks And Returns

Balancing risks and returns is key when investing in corporate bonds. While high-rated bonds are safer, they typically offer lower returns. On the other hand, bonds with lower ratings might tempt you with better yields. Consider your financial goals and how much risk you’re willing to take. If steady income is your priority, opt for higher-rated bonds. But if you’re looking to maximize returns and can handle some risk, lower-rated bonds might be worth exploring. It’s like choosing between a smooth, predictable ride and a thrilling roller coaster. Which experience aligns more with your investment comfort zone? By understanding your risk tolerance and financial objectives, you can make informed decisions about corporate bonds that align with your investment strategy.Dividend-paying Stocks

Explore 48 low-risk dividend-paying stocks ideal for beginners. These stocks offer steady income and stability. Perfect for building a reliable investment portfolio with minimal risk.

Investing in dividend-paying stocks can be a smart move for beginners looking for low-risk options. These stocks provide a dual benefit—potential for growth in stock value and a steady income stream through dividends. This blend of growth and income makes them appealing, especially when starting your investment journey.Understanding Dividend Yields

Understanding dividend yields is crucial. The yield is the annual dividend payment divided by the stock’s current price. A higher yield can mean more income for you, but it’s vital to consider the stability of the company paying it. Imagine buying a stock that pays a 3% dividend yield. If you invest $1,000, you’ll earn $30 annually, just from dividends. This figure helps you compare the income potential of different stocks. However, a high dividend yield might indicate a company in trouble, trying to attract investors. It’s essential to balance between yield and company health. Would you trust a friend who suddenly offers you too much for a simple task?Selecting Stable Companies

Choosing the right company is like choosing the right friend. You want one that’s reliable and won’t let you down. Look for companies with a history of stable or increasing dividends. Firms in sectors like utilities and consumer goods often provide consistent dividends. These industries tend to be less volatile, offering you peace of mind. Consider the company’s payout ratio, which indicates how much profit is paid as dividends. A lower ratio suggests the company has room to grow its dividend. Do you want a company that can grow with you? Investing in dividend-paying stocks requires some homework. But the reward is a more predictable income stream, providing financial stability. Start with these insights, and you’ll be on a path to making informed investment decisions.

Credit: m.facebook.com

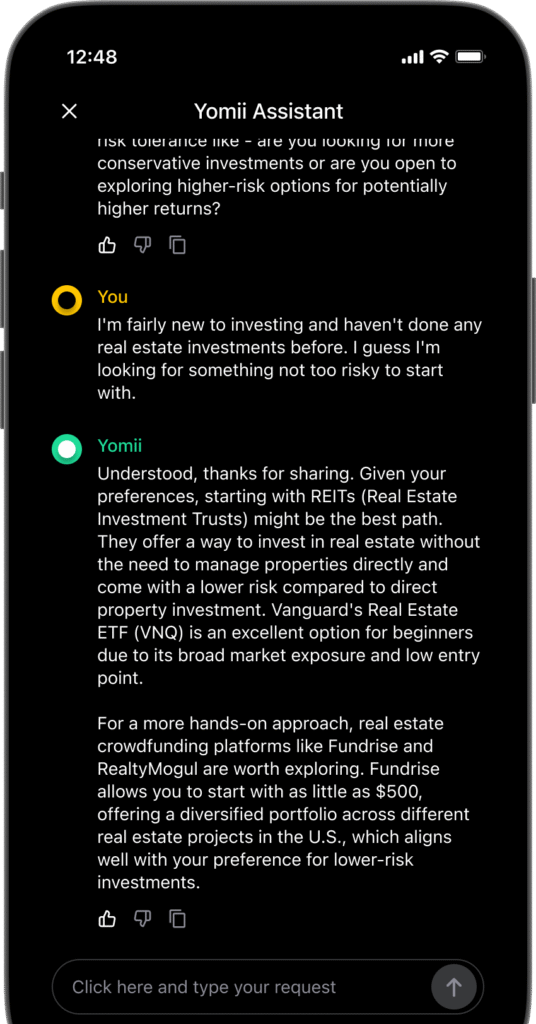

Real Estate Investment Trusts (reits)

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without owning property. They pool money from investors to buy real estate assets. This includes shopping malls, office buildings, and apartments. REITs trade on major stock exchanges. This makes them easy to buy and sell. They provide a steady income through dividends. For beginners, REITs are a low-risk option.

Benefits Of Investing In Reits

REITs offer liquidity. You can buy and sell REIT shares like stocks. This makes them more flexible than owning property. They also provide income. REITs pay high dividends to shareholders. This is appealing for those seeking regular income. Tax benefits are another perk. Some REIT dividends qualify for favorable tax treatment. This boosts your return on investment.

Diversifying Real Estate Holdings

Diversification reduces risk. REITs invest in various types of properties. This spreads risk across different sectors. For example, a REIT may own hotels, hospitals, and warehouses. This means if one sector struggles, others might perform well. Geographic diversity is another advantage. REITs invest in properties across different locations. This protects against regional market downturns. Diversifying with REITs is simple and effective.

Peer-to-peer Lending

Peer-to-peer lending offers a straightforward way to invest with lower risk. This option connects investors directly with borrowers. Ideal for beginners seeking stable returns.

Peer-to-peer lending is a fresh way to grow your money. It connects borrowers with individual lenders. This method skips banks, offering direct and personal loans. The process is simple. It suits beginners seeking low-risk investments. You can help someone and earn returns. It’s a win-win situation for both parties.How Peer Lending Platforms Operate

Peer lending platforms act as bridges. They connect borrowers to lenders online. You sign up on a platform, create a profile, and start lending. The platform assesses borrowers’ creditworthiness. It provides you with information to make decisions. You can choose whom to lend your money to. The platform handles the loan transactions. It ensures payments and manages defaults.Managing Risks In Lending

Managing risks is crucial in peer-to-peer lending. Diversify your investments across many borrowers. This spreads your risk and minimizes losses. Start with small amounts to test the waters. Read borrower profiles carefully. Check their credit scores and repayment history. Use platforms that offer buyback guarantees. This feature protects your investments from defaults. Be cautious, and stay informed for safe lending experiences. “`Robo-advisors

Robo-Advisors are transforming the investment landscape. These digital platforms use algorithms to manage portfolios. Ideal for beginners, they offer a hands-off approach to investing. Users can easily access diversified portfolios without needing deep financial knowledge. This method reduces the stress of constant monitoring. Robo-Advisors are gaining popularity due to their simplicity and efficiency.

Automated Investment Strategies

Robo-Advisors employ automated strategies to invest your money wisely. They analyze market trends and adjust portfolios accordingly. This automation minimizes human errors. It ensures decisions are data-driven, not emotional. Predictable patterns often lead to steady returns. Beginners can benefit from automated strategies without extensive research.

Cost-effective Portfolio Management

Robo-Advisors offer cost-effective solutions for portfolio management. Traditional advisors usually charge high fees. In contrast, Robo-Advisors have lower costs. This makes them attractive to investors with limited budgets. They provide professional management at a fraction of the price. Cost-effectiveness allows you to start investing without straining your finances.

Conclusion

Exploring low-risk investments helps beginners feel more confident. These options provide safety with potential growth. Start small, learn, and adapt as you grow. Diversify your choices to reduce risk. Balance security and earning potential. Research each option thoroughly before committing.

Remember, patience is key in investing. Small steps lead to bigger financial goals. Stay informed and seek advice if needed. Investing wisely can build a brighter future. Choose investments that match your comfort level. With informed decisions, financial growth is achievable.

Begin your journey today with the right investment strategy.